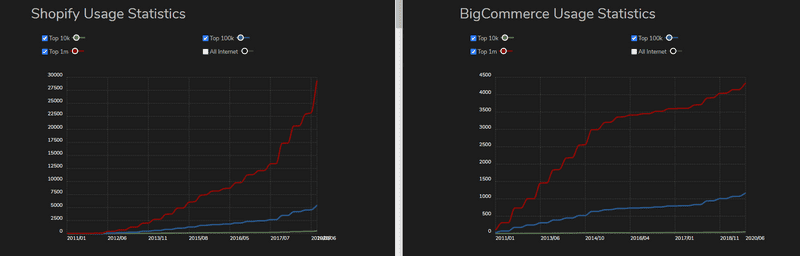

BigCommerce usage slowing compared to Shopify

BigCommerce recently went public via an IPO on the Nasdaq. There's been speculation as to how the company would be valued, given the robust performance of Shopify's stock, and the notable increase in attention the platform has received over the past 12 months. The platforms are very different from a feature standpoint and it's apparent in the usage among the most popular sites, with BigCommerce's growth slowing while Shopify's market share has increased.

The BigCommerce platform is used by far fewer sties than Shopify. The difference in usage among the most-visited sites is quite striking.

- Total Live: 1,422,815 vs 47,390

- Top 1m: 3.6% vs 0.46%

- Top 100k: 5.55% vs 1.21%

- Top 10k: 5.29% vs 0.56%

The trends appear quite different as well. While BigCommerce has been steady in the top 10k, the trajectory among the top million sites is entirely different. BigCommerce has plateaued as of late, while Shopify is surging.

Shopify is used by ~30x as many sites as BigCommerce and the gap is widening. With more users, Shopify gains advantages similar to Amazon whereby it can reinvest in the company to build a better platform, enable better partnerships, and build infrastructure that benefits all merchants on the platform. Those some opportunities don't exist for BigCommerce because of the smaller userbase. While many would like to believe the BigCommerce may be an opportunity to get into a new ecommerce platform at an early stage, BigCommerce is no Shopify.